When most people hear the word “hacker,” they picture a Hollywood scene: some genius typing furiously, numbers flying across the screen, millions being siphoned off to an offshore account, and a dramatic escape on a motorcycle into the night.

Reality, however, is far less cinematic—and much more common.

Today, financial theft doesn’t require high-speed chases or high-stakes hacking. Criminals can steal your banking information simply by walking past you on a crowded street. Thanks to RFID (Radio Frequency Identification) skimming, your financial information could be compromised without you ever noticing—and it’s easier than you think.

In fact, according to the Federal Trade Commission (FTC), credit card fraud—including skimming—resulted in over $8 billion in losses in 2020 alone.

If that doesn’t get your attention, it should.

What Is RFID?

RFID stands for Radio Frequency Identification. It’s a technology that uses radio waves to read and capture information stored on chips embedded in items like credit cards, debit cards, and passports.

RFID skimming happens when a thief uses an RFID reader to “skim” your data right off the chip—often without even touching you. They just need to get close. It’s a low-tech method with high-impact results, and it happens every single day.

Can RFID Be Hacked?

Absolutely.

Some RFID skimming devices can steal your data from just a few feet away; others, equipped with booster technology, can snag your information from across the street. Busy places—like airports, concerts, and crowded markets—are prime hunting grounds.

A recent study by FICO found that card skimming and crowd-hacking incidents surged by 77% by the end of last year. Translation? The threat is growing.

How RFID Skimming Works:

-

Proximity Reading: Your RFID chip constantly broadcasts a signal. When a skimmer with a hidden reader gets close, they capture that signal without you even noticing.

-

Data Capture: The skimmer collects your data—just like that.

-

Exploitation: With your stolen info, thieves can make unauthorized purchases, clone your cards, or commit identity theft. And here’s the kicker: it typically takes 98 days for the average consumer to detect unauthorized transactions, according to Javelin Strategy & Research.

Protecting Yourself: Choosing the Right RFID Blocking Technology

There are two main types of RFID protection:

-

Passive Blockers: The Silent Shield

These work like an invisible wall, absorbing or deflecting RFID signals to keep your information secure. -

Active Blockers: The Signal Scramblers

These devices actively jam incoming RFID signals with embedded microchips.

Adrian Kingsley-Hughes from ZDNet tested several RFID blockers and found that, although mass skimming isn’t yet a constant street-level threat, using a blocker is an easy, inexpensive preventive measure.

Still, despite growing awareness (69% of Americans know about RFID risks, according to an AARP survey), only 18% actually use RFID-blocking products. That’s a lot of people leaving their financial security to chance.

Why You Need Protection Now

If your card gets skimmed, you typically have only 60 days to report it and be eligible for a refund. Miss that window, and your financial institution isn’t required to reimburse your losses. Plus, even if you do report it in time, it can take days or even weeks for your bank to investigate and return your funds.

And with 60% of Americans lacking a spare $500 for emergencies, waiting on frozen funds can be a real crisis.

In a world where most people barely carry cash and rely almost entirely on cards, losing access to your money isn’t just inconvenient—it’s dangerous.

Meet SecureCard: Simple, Powerful Protection

That’s where SecureCard comes in.

Think of it as a force field for your wallet. Just slide the SecureCard next to your credit and debit cards, and you’re protected—no apps, no batteries, no extra bulk.

Our SecureCard has been rigorously tested and certified (NTS Certificate PR053811-ACT1005612), ensuring that all contactless cards within a 10mm radius are shielded from potential skimmers.

Whether you’re navigating the busy streets of New York, London, or your local farmer’s market, SecureCard has your back.

(When it comes to how you spend your money—say, on hotels or late-night pizza—that’s between you and your bank.)

When it comes to RFID protection, though, we’ve got you covered.

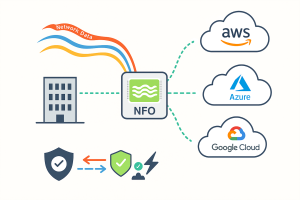

About DT Asia

DT Asia began in 2007 with a clear mission to build the market entry for various pioneering IT security solutions from the US, Europe and Israel.

Today, DT Asia is a regional, value-added distributor of cybersecurity solutions providing cutting-edge technologies to key government organisations and top private sector clients including global banks and Fortune 500 companies. We have offices and partners around the Asia Pacific to better understand the markets and deliver localised solutions.

How we help

If you need to know more about the reason of using RFID Blocking Technology, you’re in the right place, we’re here to help! DTA is Secure Data’s distributor, especially in Singapore and Asia, our technicians have deep experience on the product and relevant technologies you can always trust, we provide this product’s turnkey solutions, including consultation, deployment, and maintenance service.

Click here and here and here to know more: https://dtasiagroup.com/secure-data/